If you have been in a car accident in Massachusetts, you can expect a call from an insurance adjuster in the near future. Insurance companies often reach out quickly, sometimes within days or hours after a crash occurs.

Since dealing with insurers is not an everyday task, you may be uncertain about providing a statement when they request one. It is natural to wonder what obligations you have when the other driver’s insurance company asks for your account of the accident. Understanding your rights and responsibilities in this situation is crucial. Our team at Altman Nussbaum Shunnarah have prepared this guide to enlighten you on how you should handle the situation.

You are Not Legally Obligated to Give a Statement

You are not legally required to give a recorded statement to an insurance company in Massachusetts. If an adjuster asks you to make a recorded account, you can simply decline, as Massachusetts law does not compel you to do so.

In general, after being involved in a car accident in the state, it is advisable to avoid making any statements to insurance companies before consulting a lawyer. If you choose to speak with an insurance representative, limit what you say as much as possible.

Insurance adjusters may attempt to use your own words against you and claim you were at fault for the accident. They have vested interests that conflict with yours as the claimant. To fully protect your rights and ability to recover damages, it is best to exercise caution and refrain from providing a statement without first getting legal counsel.

Why You Should Not Give a Statement to an Insurance Company

Insurance companies are businesses motivated by profits, not acts of charity. Like most corporations, their goal is to maximize revenues and minimize expenses. When an insurance company has to pay out claims for injuries or damages caused by their insured clients, they have a vested interest in settling those claims for the lowest possible amount.

An insurance adjuster may come across as kind and understanding and claim they want to reach a fair resolution. However, even if the employee is personally sympathetic, their employer expects them to settle matters quickly while convincing them to accept the smallest payout feasible. Adjusters may even ask seemingly compassionate questions designed to get you to make statements that can later be used against you to reduce or deny your claim entirely. Something as seemingly innocuous as saying “sorry” could potentially be wielded as an admission of guilt by the insurance company’s attorneys.

After an accident, most people are understandably shaken up. If you were injured, you may be hospitalized or on medication that impairs your ability to recount events. Taking the time to calmly recollect and solidify your memories of what occurred without pressure or someone challenging your account is crucial. Insurance adjusters will carefully parse every word you say for anything they can use to undermine your claim.

Even if you received a traffic citation related to the accident, that ticket alone does not legally establish fault. You should avoid making statements construed as admissions of guilt or liability to the insurance company, regardless of whether a ticket was issued. Their financial interests are directly opposed to maximizing the compensation you receive.

Withholding your statement until you have had time to collect your thoughts and consult an attorney ensures your account is clear and consistent and protects your ability to recover an appropriate settlement. Insurance companies are not operating in good faith on your behalf, so guarding what you say is critical.

What to Say to an Insurance Adjuster and How to Say it

When speaking to an insurance adjuster, it is crucial to handle the conversation carefully. You might need to report an incident or provide some basic details, but remember to keep things concise and to the point. Here is a simple guide on handling such talks:

- Always be courteous and professional with the adjuster. Avoid getting too friendly or sharing personal stories.

- Keep calm and maintain a neutral tone. It is important not to appear agitated or confrontational.

- Set boundaries early in the conversation. Make it clear that you will only discuss specific topics.

- Share only essential personal details like your name, address, and how to contact you. Steer clear of discussing your personal life, finances, or medical history.

- Avoid discussing the extent of your injuries, treatments, or recovery progress.

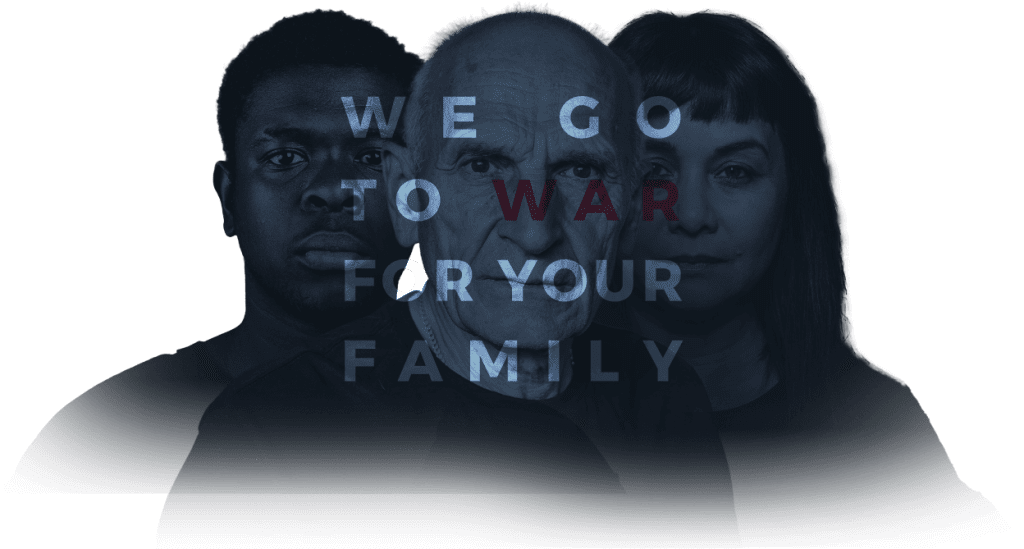

Our Attorneys at Altman Nussbaum Shunnarah Can Help You

The experienced personal injury attorneys at Altman Nussbaum Shunnarah can help deal with canny insurance companies. Do not hesitate to contact us at 617-222-2222 for a free consultation and to discuss your case.